M&A Trends in the Gold Sector

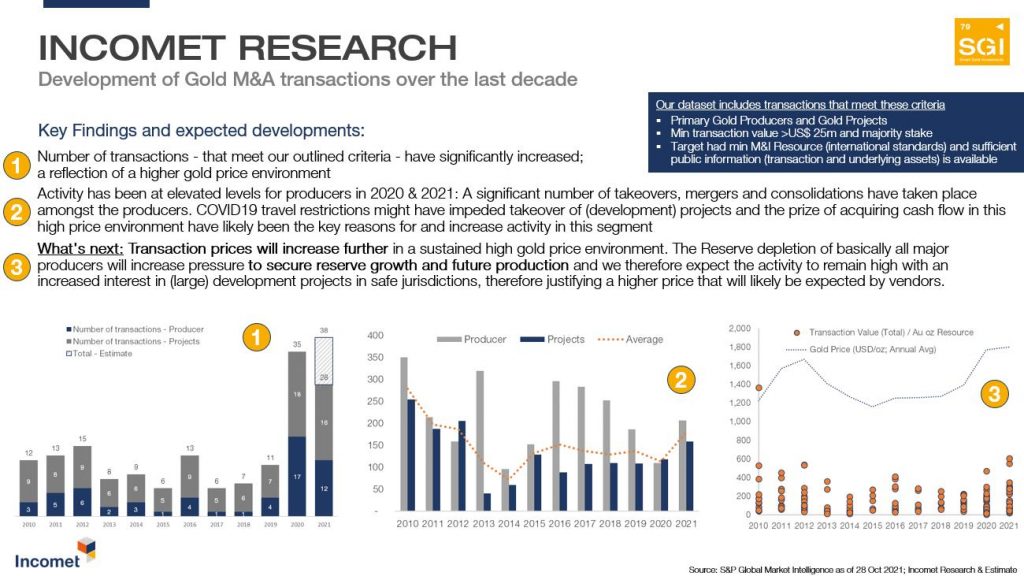

- Number of transactions – that meet our outlined criteria – have significantly increased; a reflection of a higher gold price environment

- Activity has been at elevated levels for producers in 2020 & 2021: A significant number of takeovers, mergers and consolidations have taken place amongst the producers. COVID19 travel restrictions might have impeded takeover of (development) projects and the prize of acquiring cash flow in this high price environment have likely been the key reasons for and increase activity in this segment

- What’s next: Transaction prices will increase further in a sustained high gold price environment. The Reserve depletion of basically all major producers will increase pressure to secure reserve growth and future production and we therefore expect the activity to remain high with an increased interest in (large) development projects in safe jurisdictions, therefore justifying a higher price that will likely be expected by vendors.

Download Nov 2021 Stock Day Report Article here